How to Stop a Car Repossession (Full Guide)

How to Stop a Car Repossession (Full Guide)

If you're behind on your car payments and worried about losing your vehicle, you're not alone. Thousands of people face the same fear every day—and the good news is that you have options. Even if you've missed one or more payments, there are still legal and practical steps you can take to stop or delay repossession.

This guide walks you through everything you need to know: what happens when you fall behind, your rights as a borrower, and the specific actions you can take right now to keep your car.

What Happens When You Miss a Payment

The moment you miss a car payment, your account becomes delinquent. Most lenders give you a grace period of 10–15 days before charging a late fee. However, even one missed payment can trigger collection calls and put you at risk.

After 30 days of non-payment, your lender may report the late payment to credit bureaus, which hurts your credit score. By 60 to 90 days, repossession becomes a very real possibility. Some lenders may repossess your vehicle even after just one missed payment if your loan contract allows it.

The key takeaway: time is critical. The sooner you act, the more options you have.

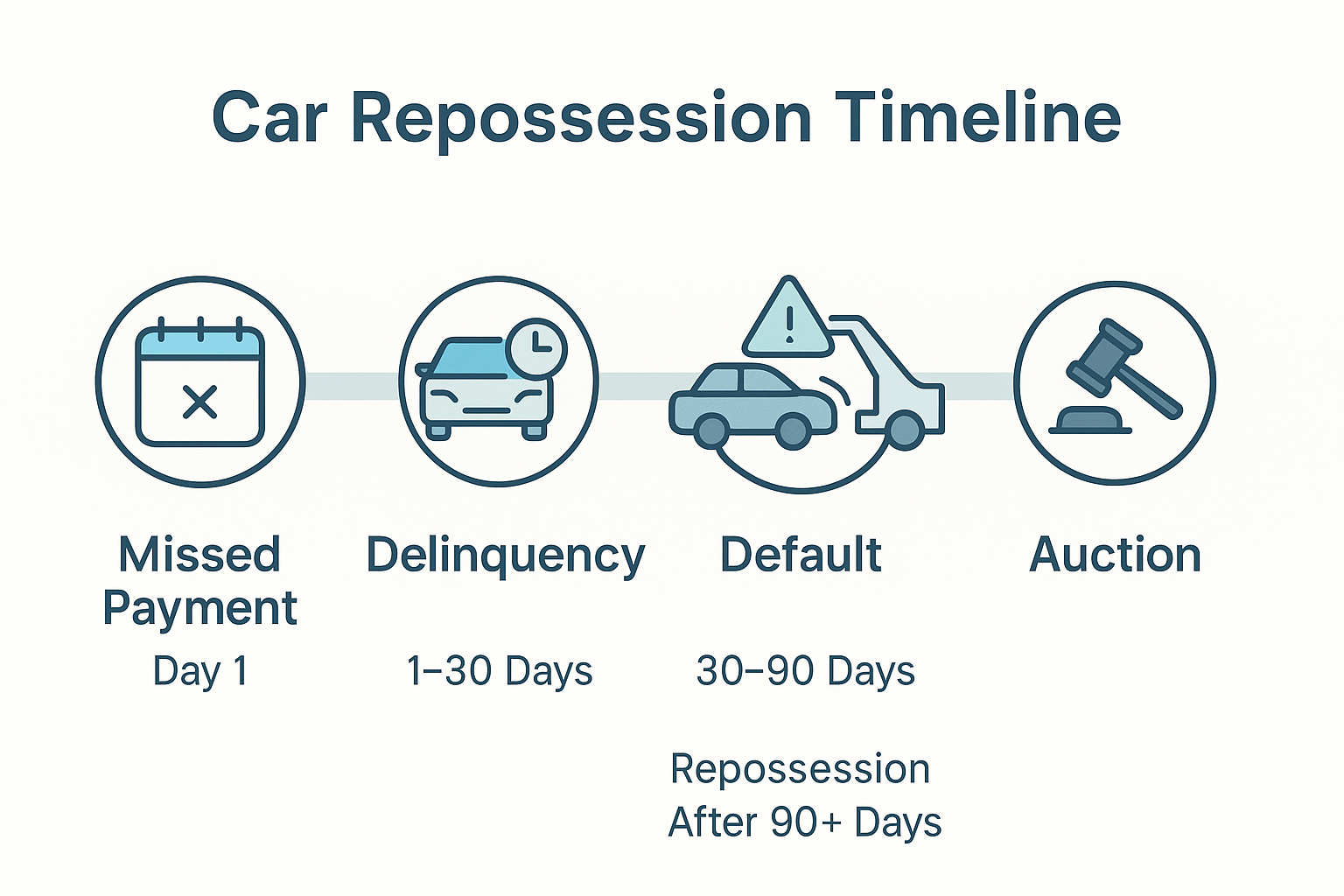

Timeline showing typical stages from missed payment to repossession

Timeline showing typical stages from missed payment to repossession

Car Repossession Timeline

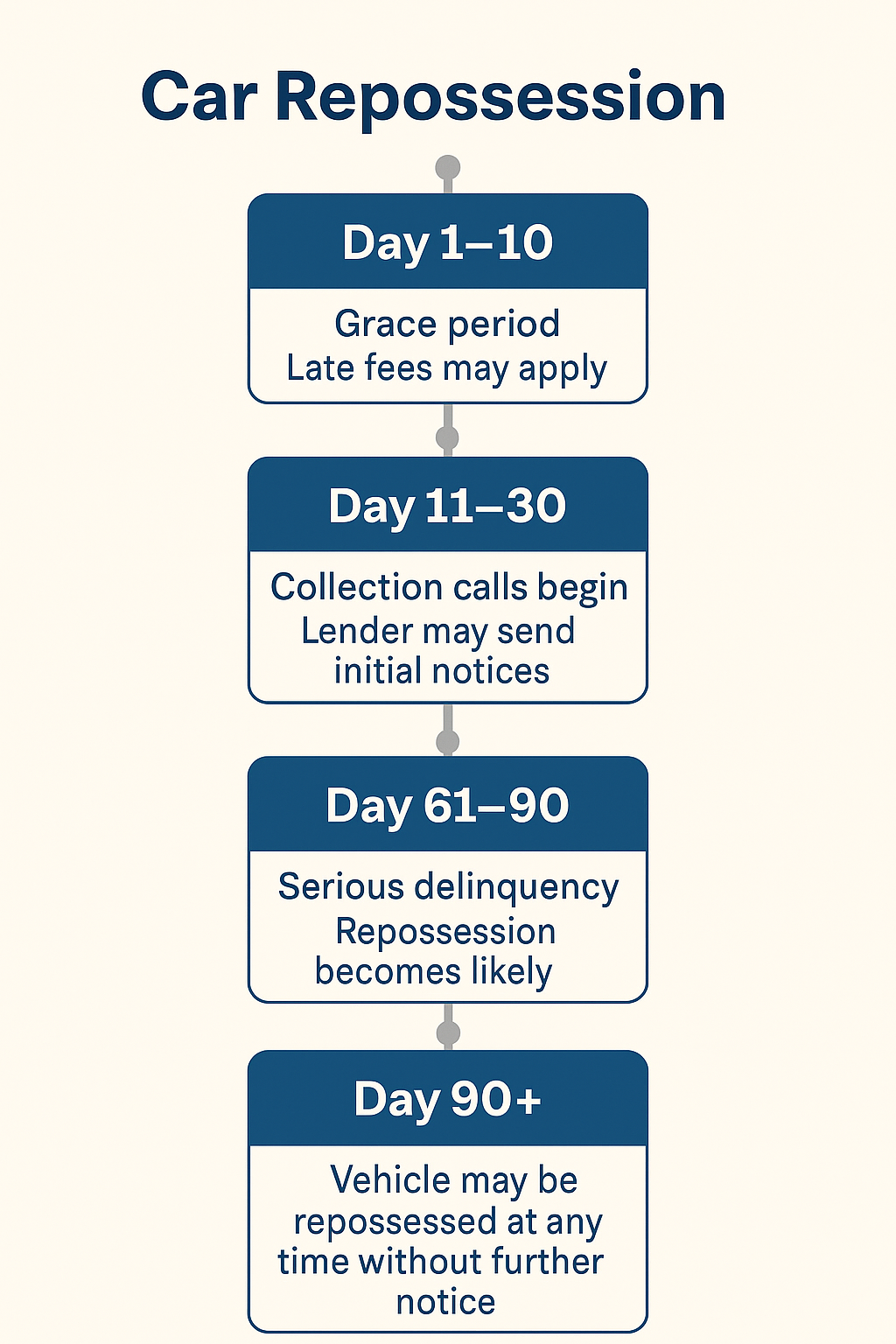

Understanding the typical repossession timeline helps you know where you stand and how much time you have to respond:

- Day 1–10: Grace period; late fees may apply

- Day 11–30: Collection calls begin; lender may send initial notices

- Day 31–60: Late payment reported to credit bureaus; lender may offer forbearance

- Day 61–90: Serious delinquency; repossession becomes likely

- Day 90+: Vehicle may be repossessed at any time without further notice

Every lender is different, and some states require additional notice before repossession. Check your loan contract and know how long before a car is repossessed in your situation.

Your Rights & State Rules

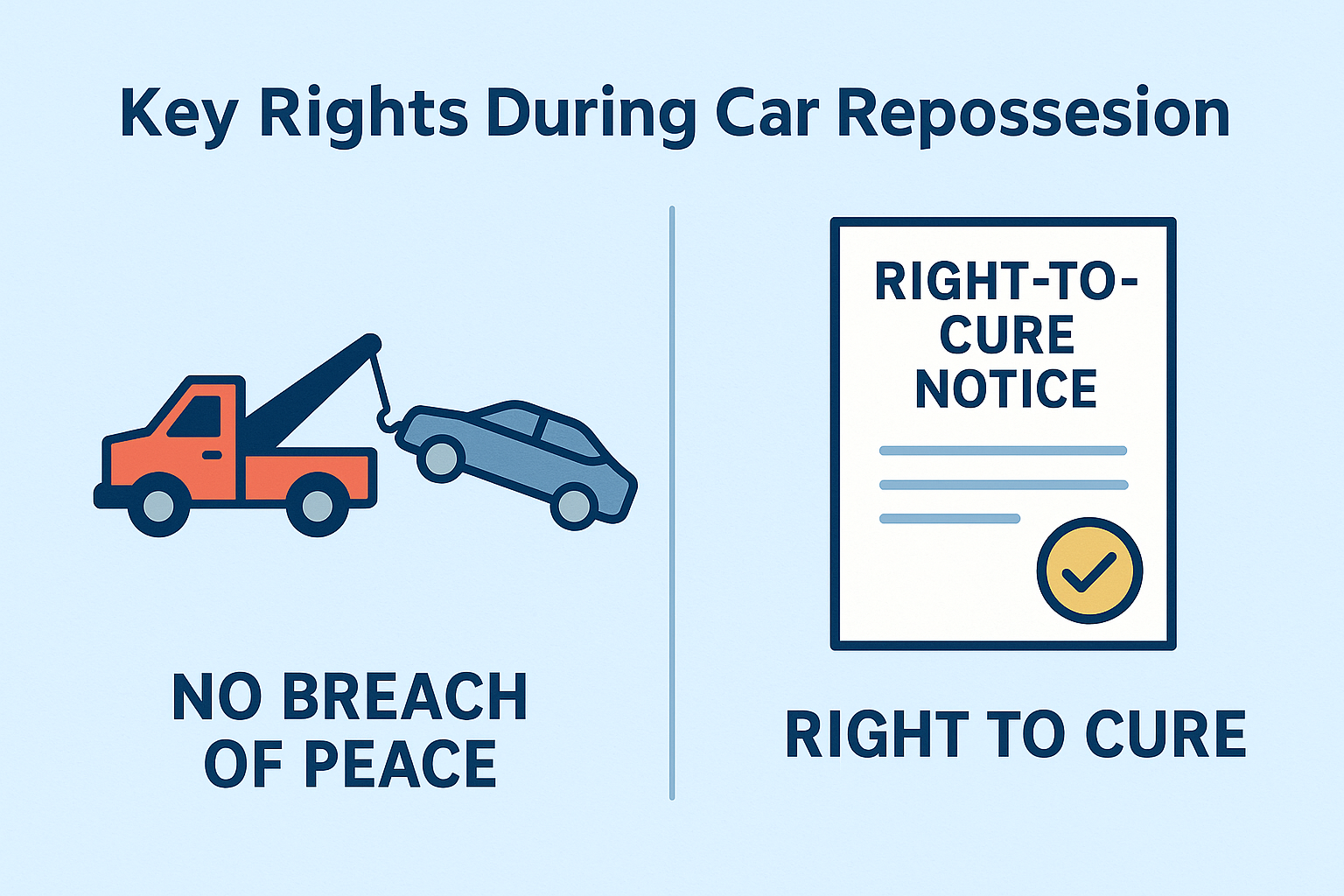

Federal and state laws protect you during the repossession process. Here are your most important rights:

Right to Notice: Some states require lenders to notify you before repossessing your car. This is called a "right-to-cure" notice, which gives you a chance to catch up on payments.

No Breach of Peace: Repo agents cannot use physical force, break into locked garages, or threaten you. If they do, it's illegal. Learn more about your rights when your car is repossessed.

Personal Property: After repossession, you have the right to retrieve personal belongings from your vehicle. The lender must tell you how and when you can do this.

Right to Reinstate or Redeem: Many states allow you to get your car back by either paying off the full loan balance (redemption) or catching up on missed payments plus fees (reinstatement).

State laws vary widely, so it's worth checking your state's specific rules on the Consumer Financial Protection Bureau's website.

Five Ways to Stop or Delay Repossession

Now for the most important part: what you can actually do to prevent your car from being taken. Here are five proven strategies:

1. Contact Your Lender Immediately

As soon as you know you'll miss a payment—or the moment you do—call your lender. Explain your situation honestly. Many lenders offer hardship programs that can:

- Defer one or two payments to the end of your loan

- Reduce your monthly payment temporarily

- Extend your loan term to lower payments

Lenders want to avoid repossession too—it costs them money. If you're proactive, they're often willing to work with you. See can you stop a repossession after missing a payment for more details on what to say.

2. Apply for a Loan Modification or Refinance

If you're struggling with high monthly payments, you may qualify for a loan modification (restructuring your existing loan) or refinancing (taking out a new loan with better terms). This works best if:

- Your credit hasn't dropped too much

- You have some income to show

- Your car still has equity

Shop around with credit unions and online lenders. Even a small reduction in your interest rate can make a big difference.

3. Negotiate a Payment Plan

Ask your lender if they'll accept a partial payment now and a plan to catch up over the next few months. For example, you might pay half of what you owe this month, then add an extra $100 to each of the next few payments until you're current.

Get any agreement in writing. If your lender agrees verbally but doesn't document it, you could still face repossession.

4. Sell or Trade In Your Car

If keeping up with payments isn't realistic, consider selling the car yourself. You can often get more money from a private sale than your lender would get at auction.

If you owe more than the car is worth (called being "upside down"), you'll need to cover the difference or negotiate with your lender to settle for less. This is tough, but it can prevent repossession from showing up on your credit report.

5. Consider Bankruptcy (Last Resort)

Filing for Chapter 13 bankruptcy triggers an "automatic stay," which immediately halts all collection activity, including repossession. Chapter 13 allows you to keep your car and catch up on missed payments over a 3–5 year repayment plan.

Bankruptcy is a serious step with long-term consequences, so consult with a bankruptcy attorney before deciding. But if you're facing repossession along with other debts, it may be your best option.

Taking proactive steps like calling your lender can save your vehicle

If Your Car Was Already Taken

If your car has already been repossessed, you may still have options:

Reinstatement: Pay all past-due amounts, plus repossession and storage fees, to get your car back. You'll typically have 10–15 days to do this.

Redemption: Pay off the entire loan balance in full. This is expensive, but it's your right under most state laws.

Bid at Auction: If the lender plans to sell your car at auction, you can attend and bid on it yourself. This is rarely practical, but it's an option.

Negotiate the Deficiency: After the car is sold, if the sale price doesn't cover what you owe, you're responsible for the difference (called a deficiency balance). You may be able to negotiate a settlement for less than the full amount.

Protect & Rebuild Your Credit

Whether you keep your car or not, protecting your credit should be a priority. Here's how:

- If you negotiate a payment plan or loan modification, make sure the lender agrees not to report you as delinquent during the plan

- If repossession is unavoidable, voluntarily surrendering the car (instead of waiting for it to be taken) may look slightly better on your credit report

- After the situation is resolved, focus on rebuilding: pay all bills on time, keep credit card balances low, and monitor your credit report for errors

A repossession stays on your credit report for up to seven years, but its impact decreases over time, especially if you maintain good credit habits afterward.

Tools That Help

Navigating a potential repossession is stressful, but you don't have to do it alone. KeepMyCar.org offers free tools designed specifically for people in your situation:

- Repo Countdown Tool: See exactly how much time you have before repossession becomes likely

- Hardship Letter Generator: Create a professional letter to send to your lender explaining your situation and requesting help

- Financial Quiz: Get personalized recommendations based on your specific circumstances

👉 Next step: Use our Repo Countdown Tool or Generate a Hardship Letter.

⚠️ Disclaimer: KeepMyCar.org is not a lender, law firm, or financial advisor. All tools and content are for informational purposes only. Always confirm your rights and options with your lender or a qualified professional in your state.